Global Biomedical M&A Network

Shih-Hsin Chen, Shang-Lun Huang, Yu-Ting Chou

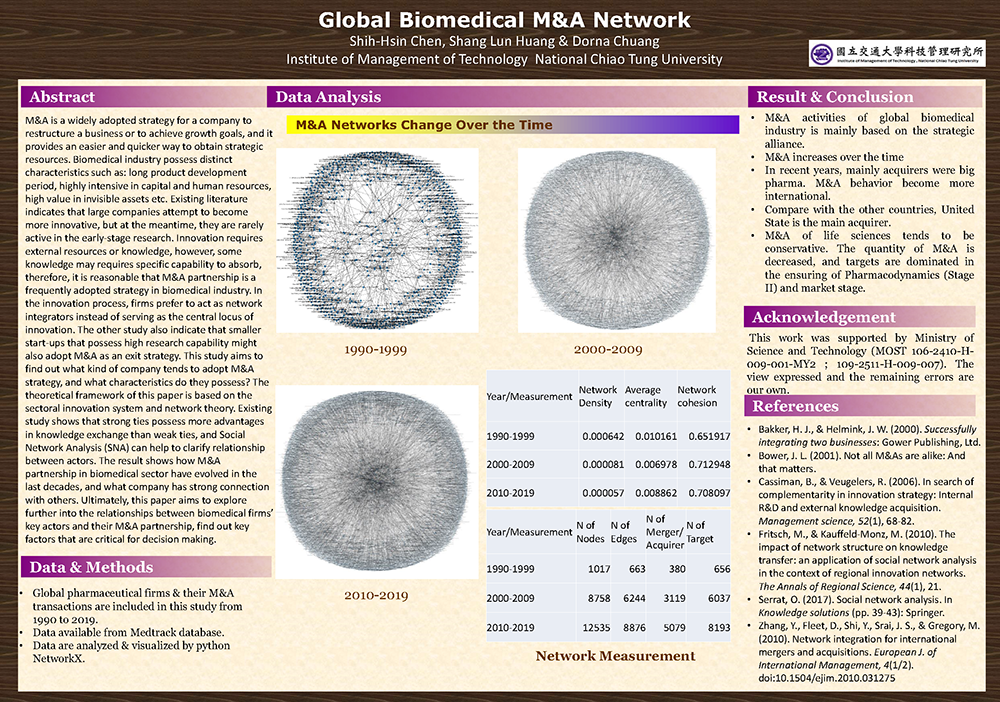

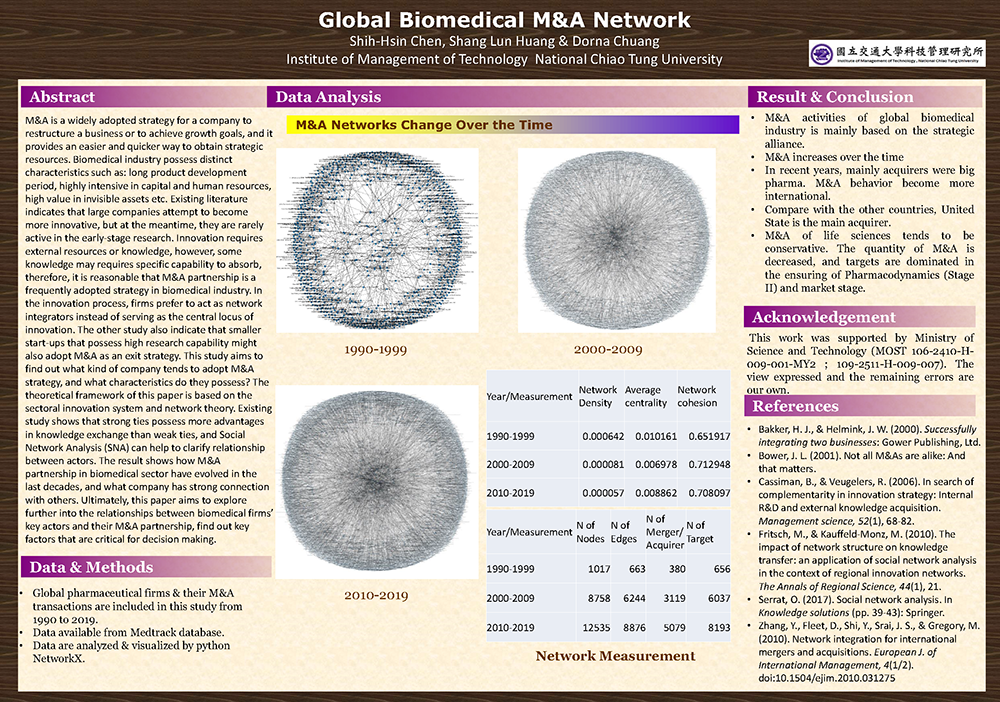

M&A is a widely adopted strategy for a company to restructure a business or to achieve growth goals, and it provides an easier and quicker way to obtain strategic resources (Bakker & Helmink, 2000; Bower, 2001; Zhang, Fleet, Shi, Srai, & Gregory, 2010). In comparison with other industries, biomedical industry possess distinct characteristics such as: long product development period, highly intensive in capital and human resources, high value in invisible assets etc. Existing literature indicates that large companies attempt to become more innovative, but at the meantime, they are rarely active in the early-stage research (Ahlfvengren & Blomqvist, 2017). Innovation requires external resources or knowledge (Cassiman & Veugelers, 2006), however, some knowledge may requires specific capability to absorb, therefore, it is reasonable that M&A partnership is a frequently adopted strategy in biomedical industry. Rafols et al. (2014) pointed out that giant pharmaceutical firms prefer to adopt open innovation in their R&D process in recent years. In other words, in the innovation process, firms prefer to act as network integrators instead of serving as the central locus of innovation. The other study also indicate that smaller start-ups that possess high research capability might also adopt M&A as an exit strategy (Ahlfvengren & Blomqvist, 2017). This study aims to find out what kind of company tends to adopt M&A strategy (for both merging/acquiring company and merged/acquired company), and what characteristics do they possess? The theoretical framework of this paper is based on the sectoral innovation system and network theory. Existing study shows that strong ties possess more advantages in knowledge exchange than weak ties (Fritsch & Kauffeld-Monz, 2010), and Social Network Analysis (SNA) can help to clarify relationship between actors (Serrat, 2017). Applying social network analysis (by using UCINET bundle with NetDraw) on the longitudinal M&A data (2000-2019) collecting from Medtrack database provides clear relationship structure between biomedical firms. The result will show how M&A partnership in biomedical sector have evolved in the last decade, and what company has strong connection with others. Data obtained from Medtrack provides thorough detail of every M&A deal, such as: Deal Category, Source Company, Partner Company, Drug Indication, Therapeutic Category, Technology, Deal Geography, Deal industry, Deal Value and Total Upfront. Those categories will act as attributes to the partnership deal, machine learning approach will be applied, and results will show how each attribute affect the deal. Ultimately, this paper aims to explore further into the relationships between biomedical firms’ key actors and their M&A partnership, find out key factors that are critical for decision making.

← Schedule